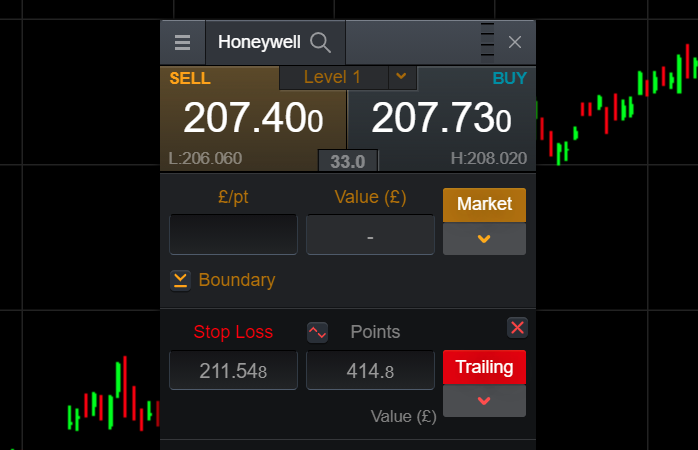

To understand the difference between the bid price and the ask price of a financial instrument, you must first understand the current price from a trading perspective.

The current price, also known as the market value, is the actual selling price of an asset on an exchange. The current price is constantly fluctuating and is determined by the price at which that asset last traded. Basic economic theory states that the current price is determined where the market forces of supply and demand meet. Fluctuations to either supply or demand cause the current price to rise and fall respectively.

The current price on a market exchange is therefore decided by the most recent amount that was paid for an asset by a trader. It’s the consequence of financial traders, investors and brokers interacting with one another within a given market.