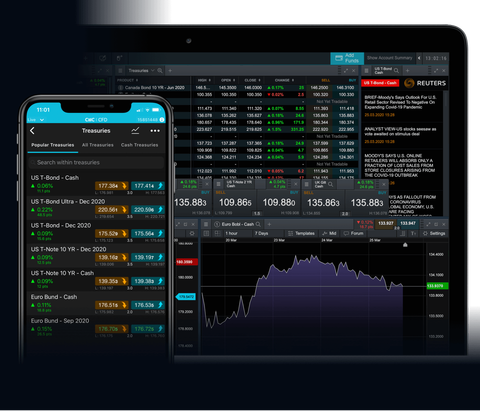

Rates and bonds trading

Trade on over 50 government bond and interest-rate instruments with leverage on our award-winning spread bet and CFD platform. With tight spreads, lightning-fast execution and the highest customer satisfaction in the industry.*

More than a bonds trading platform

Over 50 global rates & bonds

Spread bet and trade CFDs on interest rates and government debt obligations, such as gilts, bonds, bunds and treasury notes.

Minimal slippage

With fully automated, lightning-fast execution in 0.0075 seconds**.

No partial fills

And never any dealer intervention, regardless of your trading size.

99.9% fill rate^

Almost all of our rate & bond trades fill with no dealer intervention, regardless of your trading size.

Dedicated customer service

US based, award-winning service online 24/5, whenever you're trading.

Trade out of hours

Favourites like the US T-Bond trade up to 23 hours a day, so you don't have to stop when the underlying markets do.

50+ rates and bonds at your fingertips

Get exposure to interest rates and government debt obligations, with spreads from as low as 1 point.

Other popular treasuries

Pricing is indicative. Past performance is not a reliable indicator of future results.

Our bonds trading costs

Whatever you trade, costs matter. We’re committed to keeping our costs as competitive and transparent as possible, whether you trade on the US T-Note, UK Gilt or Eurodollar.