Spread bets and CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 77% of retail investor accounts lose money when spread betting and/or trading CFDs with this provider. You should consider whether you understand how spread bets and CFDs work and whether you can afford to take the high risk of losing your money.

What does 'buying on margin’ mean and how can I do it?

When buying on margin via spread betting or CFDs, you don’t actually own the underlying asset, but instead you can gain magnified exposure to the instrument’s price movements.

Find out how margin trading works on the CMC Markets platform by placing trades using a demo account. This article explains what buying on margin is, the benefits and risks, how to place margined trades, including what an initial margin requirement is, and includes examples of margin calls.

What is buying on margin?

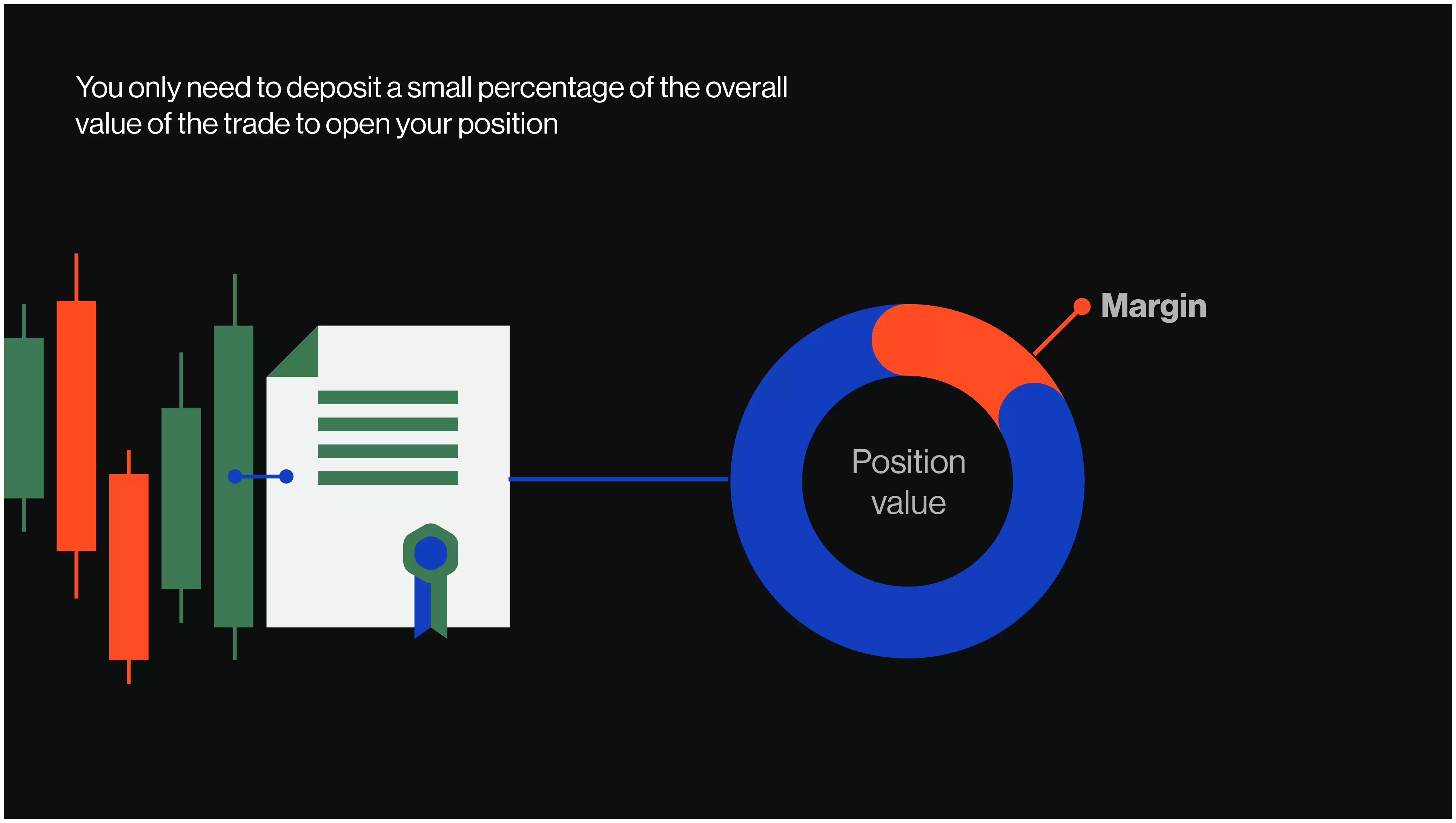

Buying on margin means that a trader or investor does not need to have the full value of the trade in cash, only part of it, to go long. Because profit and loss are based on a trade’s full position, margin trading can amplify both.

The margin amount or percent is how much of the transaction value you need to have in your account to make the trade.

For example, assume a trader wishes to buy 100 shares priced at £100, and the margin rate is 20%. This trade has a value of £10,000, but the trader doesn’t need £10,000 in their account to make the trade, they only need £2,000 (20% of £10,000). Again, it’s worth noting that when spread betting and trading CFDs, you don’t actually own the underlying asset; you only gain exposure to its price movements.

Trading with leverage or margin are similar concepts, expressed in different ways. Margin trading is how much of the trade value you need in your account to initiate the trade, such as the 20% discussed above. Leverage is the size of the position relative to the amount of capital required to initiate the position. For example, a £10,000 trade with £2,000 in the account means a leverage ratio of 5:1 is being used.

Different financial instruments have different margin requirements. For example, at CMC Markets, we offer 20% margin when trading on shares, 5% or less on many forex pairs and 5% margin on most indices.

How does buying on margin work with spread betting and CFDs?

Both derivative products, spread betting* and contracts for difference (CFD trading), have margin requirements, which vary by asset class.

A trader making a spread bet or CFD trade doesn’t own the asset being purchased. Rather, they are opening a contract that will make or lose money based on how the underlying asset performs.

The margin rate lets the trader know how much capital they need in their account to place a spread bet or CFD trade. If they are trading on a forex pair with 3.34% margin, then they only need to have 3.34% of the trade value in the account to initiate the trade. The trade value is provided on each order ticket within our platform, along with the margin requirement in GBP (or whatever currency the account is denominated in).

In a CFD account, the trader decides how many contracts or units of the asset they wish to purchase. This determines the trade value. For example, they may choose to buy or sell $5,000 on the EUR/USD when forex trading or buy 100 shares of stock.

In a spread betting account, the trader chooses how much they wish to risk for each point of movement. This determines the value of the trade. For example, they may choose to risk £1/point in on an index, currency pair or stock.

Spread bet or trade CFDs using margin

Buying on margin vs buying in a cash account

There are several key differences between buying in a cash account and buying on margin.

| Buying on margin | Buying with cash |

|---|---|

| Only need part of the transaction value in the account at the time of the trade. | Need the full amount of the transaction value in the account at the time of the trade. |

| Potential to magnify profits and losses. These equal the price movements of the underlying asset multiplied by leverage. | Profits and losses are not magnified. They are based entirely on the price movements of the asset. |

| Margin rates vary between assets. | Margin rates don’t matter because the trader is funding the whole transaction. |

| The amount of money that is leveraged is subject to borrowing costs or overnight holding costs (discussed below). | No borrowing costs. |

| Traders can go long or short in a margin account. | A margin account is required to enter short trades. |

Example of buying on margin

Assume a trader with a margin account wants to buy 10 shares of Vodafone stock, trading at £115. The value of this transaction is £1,150, but the margin trader is only required to have 20% of this in the account, or £230.

Assume the shares rise to a price of £130, and the trader sells. The profit is £1,300 - £1,150 = £150. That is a £150 profit on £230 because that is all that was required to make the trade, setting a profit of 65%.

Had the trader accessed a cash account with £230 in it, they would have been able to gain exposure to only two shares, not 10, so their profit would have been £30 (2 shares x £15 profit), or 13%.

Because it was a winning trade, the trader buying on margin has a bigger, or magnified, return.

What are the risks when buying on margin?

While gains are magnified when buying on margin, so are losses. Margin means you are gaining exposure to assets worth more than the cash in the account. If those assets fall in value, they can rapidly deplete the amount of cash in the account.

While buying on margin does have more risk than not using margin, the risks can be controlled by using stop-loss orders and managing position sizes. A stop-loss order closes out a trade if a certain amount of money is lost or the price of the asset falls to a certain level. Managing a trader’s position size is controlling how much is bet on each trade, because betting too big can result in large losses if the price doesn’t move as expected.

What are the costs of buying on margin?

Spread betting and CFDs can incur overnight holding costs as they are margined products. Overnight fees vary by asset class and be can positive (you get paid interest to hold an asset overnight) or negative (you are charged), depending on the asset and the direction of the trade.

Typically, holding a trade overnight will incur a small fee. For example, the fee on shares is the interbank rate plus 0.0082%.

Interbank rates vary by country, so overnight holding costs may vary based on the asset’s home currency. This would be applicable if trading assets in more than one country. UK shares use the UK interbank rate, while US shares use the US interbank rate, and the same concept applies to other assets.

How do I buy on margin?

Open a demo account to practise placing trades and seeing how margin works. When you’re ready to open a live account and trade on margin, here are numbered steps on how to buy on margin in a spread betting and CFD account:

- Open a live account to place trades on margin.

- From the product library, select an asset to trade.

- Click the buy or sell buttons to bring up an order ticket window.

- Choose how much you wish to risk per point of movement (or position size).

- The platform will fill the transaction value, and you will also see the amount of capital (margin) required to make the trade.

- You may have more or less capital than the margin amount in the account. If you have less than the margin amount, you need to decrease the risk per point or position size. If you have more capital in the account than the margin amount, this is fine. If you place the trade, the margin amount will remain in the account, but that capital will be unavailable for other trades since it is being held as margin for this one.

- Place a stop-loss order or take profit order on the trade, if desired, as part of a thorough risk-management strategy.

- Click ‘Place Order’ to initiate the trade and monitor the profit or loss of the trade in the ‘position’ window.

How can I use margin trading to supplement my existing portfolio?

If you have an existing core portfolio purchased with cash, that can be kept the same if you wish. But some traders opt to leverage any spare cash they own to trade short-term fluctuations.

For example, if there is £5,000 in the account not currently being used, that could be used to take margined day trades or swing trades. That money could be used to take up to £25,000-worth of positions in margined stock trades, or £100,000 or more in margined forex trades, for example. But remember, your losses or profits from leveraging that £5,000 will be magnified, so be sure to use prudent risk management to protect your account balance.

If an asset is experiencing a strong trend, this may be an occasion where traders margin the cash available in the account to take advantage of the trend. This has the potential to magnify returns, while keeping the core portfolio the same. Remember that losses will also be magnified at the same time.

*Spread betting is available to UK and Irish clients only.

Disclaimer: CMC Markets is an execution-only service provider. The material (whether or not it states any opinions) is for general information purposes only, and does not take into account your personal circumstances or objectives. Nothing in this material is (or should be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person. The material has not been prepared in accordance with legal requirements designed to promote the independence of investment research. Although we are not specifically prevented from dealing before providing this material, we do not seek to take advantage of the material prior to its dissemination.