What is margin?

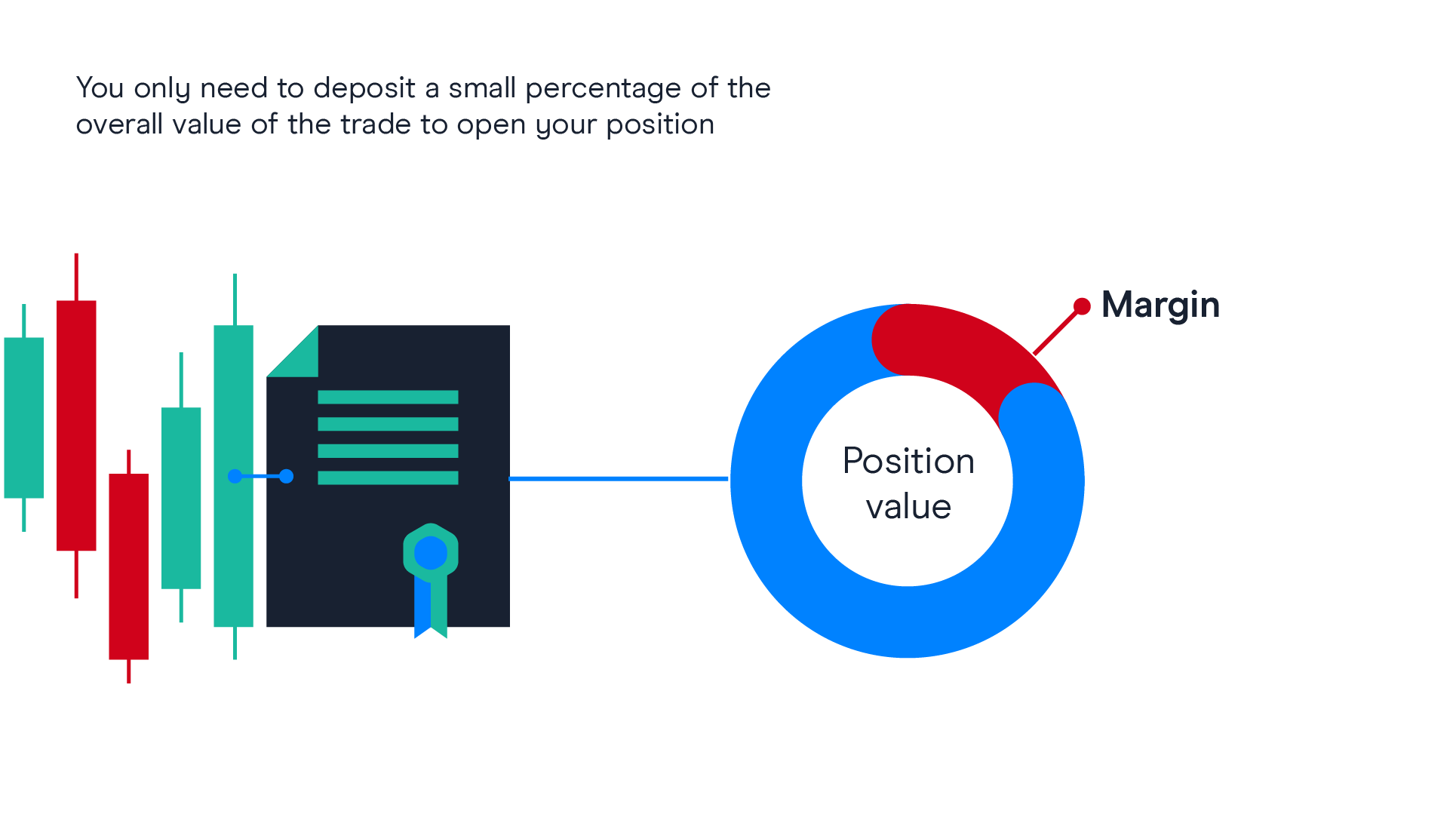

When trading on margin, you can invest more than the money that you already have in your trading account with your broker. You borrow money from your broker to leverage your trades and get higher returns.

It is important to remember that with margin trading, profits and losses are based on the full value of your trade. Margin trading can magnify gains, but it can also significantly magnify losses if the trade moves against your predictions. As a result, it is possible that you could lose more than you deposit. Margin trading can be a double-edged sword, so it makes sense to research the markets, build an effective strategy, and create your strategy template before you start trading.

Spread betting and CFD trading are popular forms of financial derivative trading that enable traders to trade on margin. Spread betting is available in the UK only, while CFD trading is available globally across many countries.