CFD meaning

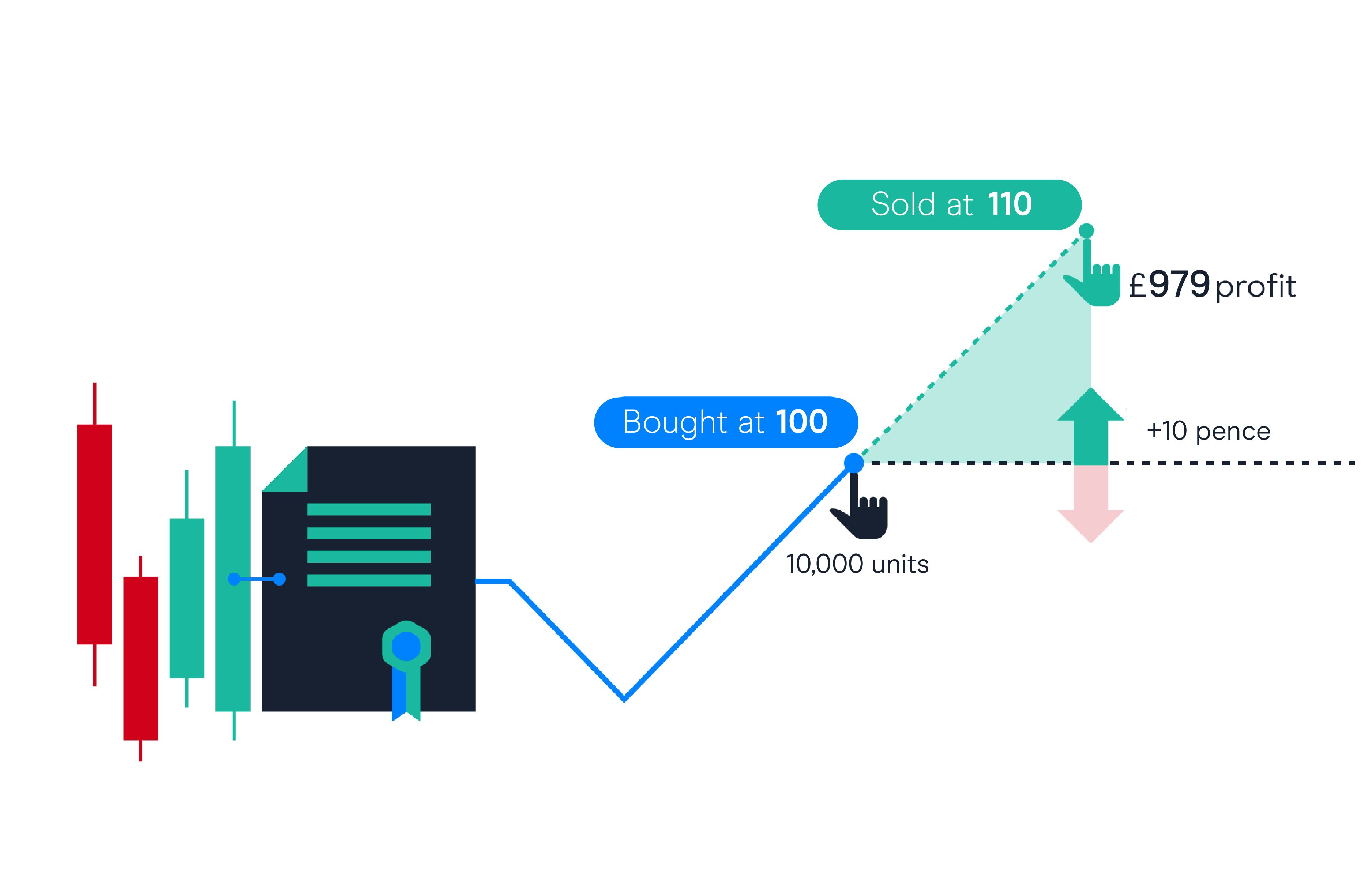

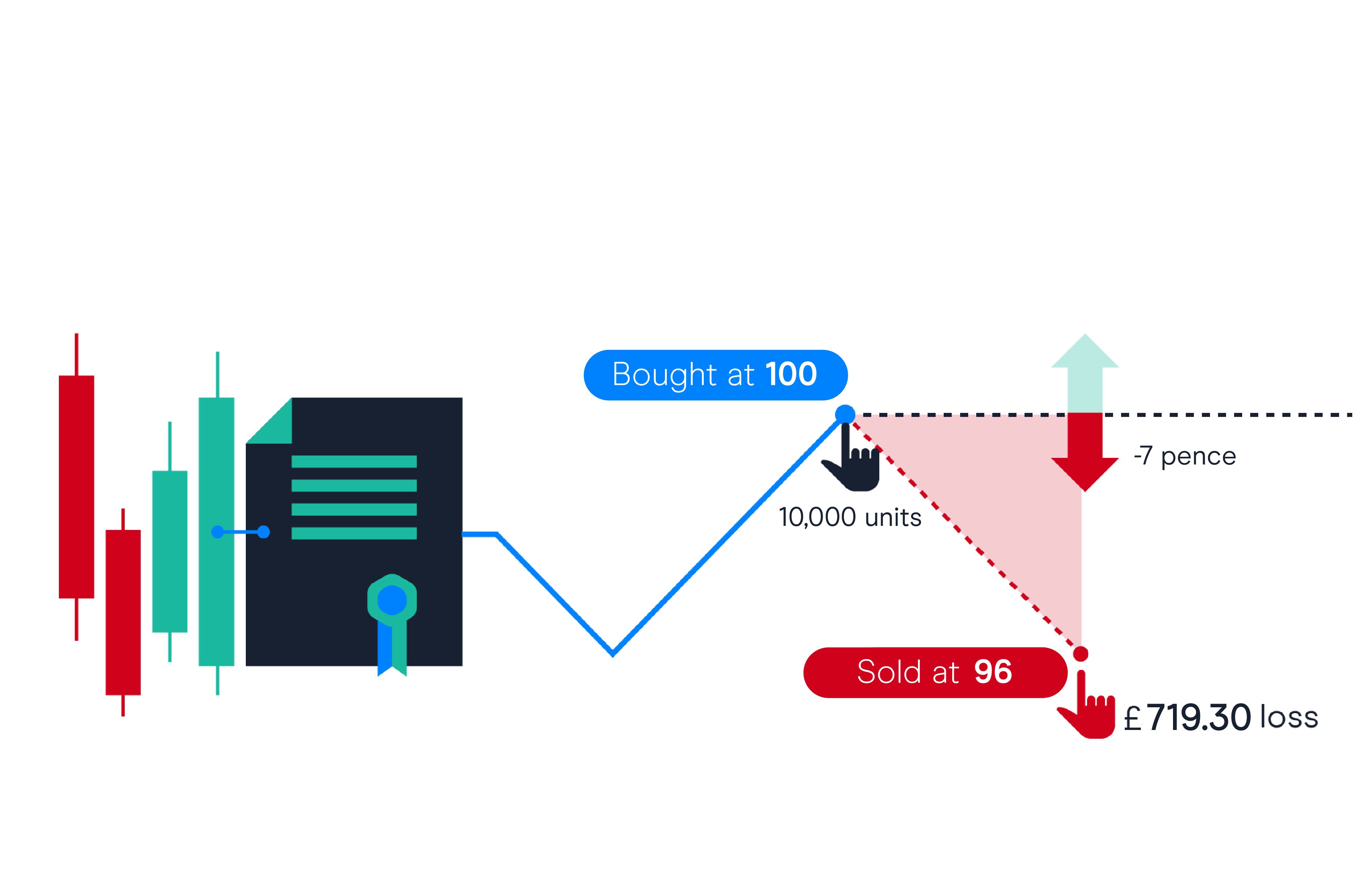

The meaning of CFD is 'contract for difference', which is a contract between an investor and an investment bank or spread betting firm, usually in the short-term. At the end of the contract, the parties exchange the difference between the opening and closing prices of a specified financial instrument, which can include forex, shares and commodities. Trading CFDs means that you can either make a profit or loss, depending on which direction your chosen asset moves in.